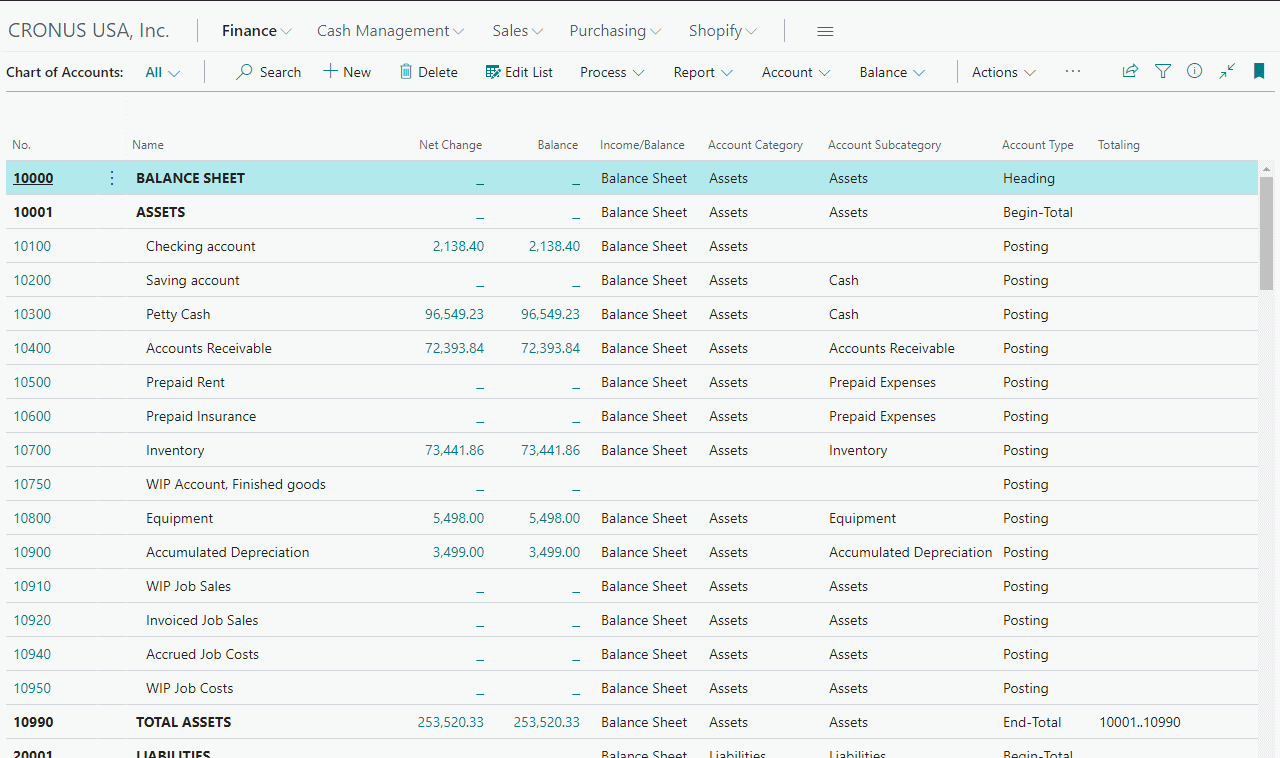

There’s often an option to view all the transactions within a particular account, too. Small businesses may record hundreds or even thousands of transactions each year. A chart of accounts (COA) is a comprehensive catalog of accounts you can use to categorize those transactions. Think of it as a filing cabinet for your business’s accounting system.

Best Free Accounting Software of 2024

Finance Strategists has an advertising relationship with some of the companies included on this website. We may earn a commission when you click on a link or make a purchase through the links on our site. All of our content is based on objective analysis, and the opinions are our own. That doesn’t mean recording every single detail about every single transaction. You don’t need a separate account for every product you sell, and you don’t need a separate account for each utility.

Financial Forecasting and Modeling

These earnings are retained within the company to be reinvested in the business, finance expansions, or repay debt. Retained earnings can positively impact the company’s financial stability and growth prospects. In summary, a well-designed Chart of Accounts is crucial to an organization’s financial success. By having a clear understanding of the COA’s purpose, structure, and organization, businesses can maintain accurate financial records and make informed decisions based on reliable data. A chart of accounts is a list of all accounts used by a company in its accounting system.

Part 2: Your Current Nest Egg

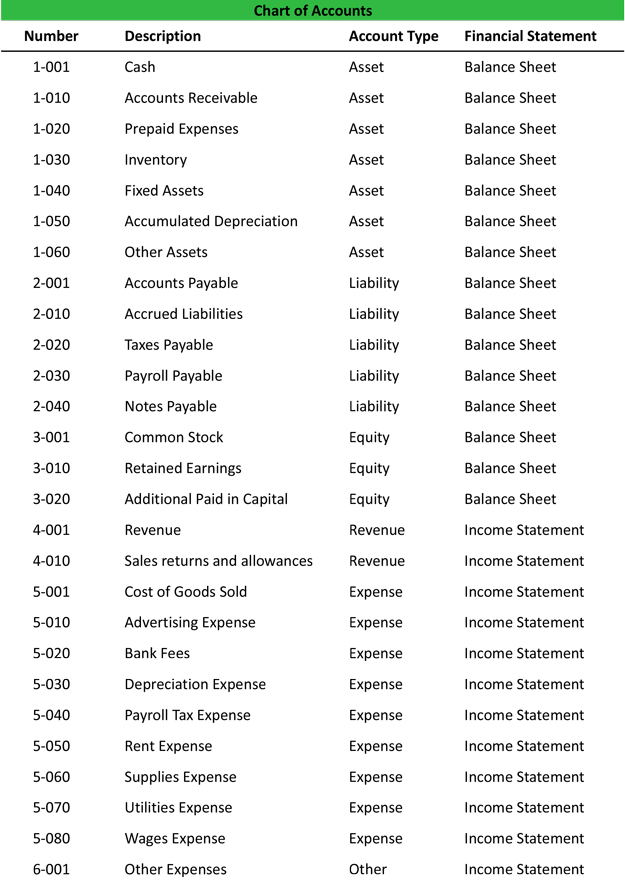

For instance, accounts in the categories of “operating revenues” and “operating expenses” can be further organized according to business function as well as company divisions. When setting up a chart of accounts, it’s important to establish a consistent and logical account numbering system. This numbering system, or coding system, assigns an identification code to each account, making it easier to locate and track different transactions. Generally, account numbers consist of digits that represent the various account categories and subcategories.

Give Some Love to COA

On the other hand, organizing the chart with a higher level of detail from the beginning allows for more flexibility in categorizing financial transactions and more consistent historical comparisons over time. In addition to the universal general accounts that are prevalent in most entities, each entity will include certain accounts that are particular to its industry sector. Instead, each entity has the flexibility to customize its accounts chart to fit the specific individual needs of the business.

For example, not all accounting systems like Quickbooks include accounts for other gains and losses. When a company trades in or disposes of a vehicle, it often incurs a gain or loss on the trade or sale. Assume Big Bill’s Construction Co. purchased a work truck for $10,000 in 2005. He sells his old truck and gets a $1,500 and purchases a new truck for $25,000. To accomplish this, test to see if your chart of accounts passes the Mystery Accountant Test.

11 Financial may only transact business in those states in which it is registered, or qualifies for an exemption or exclusion from registration requirements. 11 Financial’s website is limited to the dissemination of general information pertaining to its advisory services, together with access to additional investment-related information, publications, and links. Yes, each business should have its own Chart of Accounts that outlines the specific account categories and numbers relevant to their operations. We believe everyone should be able to make financial decisions with confidence. A record in the general ledger that is used to collect and store similar information. For example, a company will have a Cash account in which every transaction involving cash is recorded.

- Each account in the chart of accounts is typically assigned a name and a unique number by which it can be identified.

- The most important component when working with a chart of accounts is consistency, which enables the comparison of financials across multiple accounting periods and business units.

- Accordingly, the information provided should not be relied upon as a substitute for independent research.

- A COA is a list of the account names a company uses to label transactions and keep tabs on its finances.

A chart of accounts, or COA, is a list of all your company’s accounts, together in one place, that is a part of your business’s general ledger. It provides you with a birds eye view of every area of your business that spends or makes money. The main account types include Revenue, Expenses, Assets, Liabilities, and Equity. Large and small companies use a COA to organize their finances and give interested a chart of accounts usually starts with parties, such as investors and shareholders, a clear view and understanding of their financial health. Separating expenditures, revenue, assets, and liabilities helps to achieve this and ensures that financial statements are in compliance with reporting standards. To better understand the balance sheet and income statement, you need to first understand the components that make up a chart of accounts.

This method allows for easier comparisons between companies of different sizes and helps identify trends in expenses and profitability. The table below reflects how a COA typically orders these main account types. It also includes account type definitions along with examples of the types of transactions or subaccounts each may include. The Chart of Accounts is an indispensable tool in the realm of accounting, vital for accurate and efficient financial management. Understanding its structure, types, and best practices is key to maintaining an organized financial record-keeping system.

This structure can avoid confusion in the bookkeeper process and ensure the proper account is selected when recording transactions. You can think of this like a rolodex of accounts that the bookkeeper and the accounting software can use to record transactions, make reports, and prepare financial statements throughout the year. Many organizations structure their COAs so that expense information is separately compiled by department. Thus, the sales department, engineering department, and accounting department all have the same set of expense accounts. Examples of expense accounts include the cost of goods sold (COGS), depreciation expense, utility expense, and wages expense. A chart of accounts has accounts from the balance sheet and income statement and feeds into both of these accounts.

Current assets are those that can be converted into cash or used up within one year, such as cash and inventory. Non-current assets are long-term resources, such as property, plant, and equipment. This classification helps businesses assess their liquidity and long-term financial health. A balance sheet provides insights into a company’s financial position at a specific point in time. It includes assets, liabilities, and owners’ equity, making it a valuable tool for understanding a company’s resources and financings. Assets represent what a company owns, liabilities represent what a company owes, and owners’ equity represents the shareholders’ investment.