With respect to real estate investment means, there are various possibilities to discovered financial support to possess a task. Two of the most commonly known present to possess money spent capital try personal lenders and you can antique loans from banks, also known as a home loan. Before you choose which type of a home lending works best for assembling your shed, it is important to understand the differences when considering a private bank and you may a lender financial.

Private Financing versus Financial Financing

While every provides money, a sensible a property individual should be aware of the distinctions both. Banking companies is typically economical, but they are more complicated to work alongside plus difficult to rating that loan accepted that have. Personal lenders tend to be more flexible and you may responsive, however they are along with more pricey.

What’s a lender Financial?

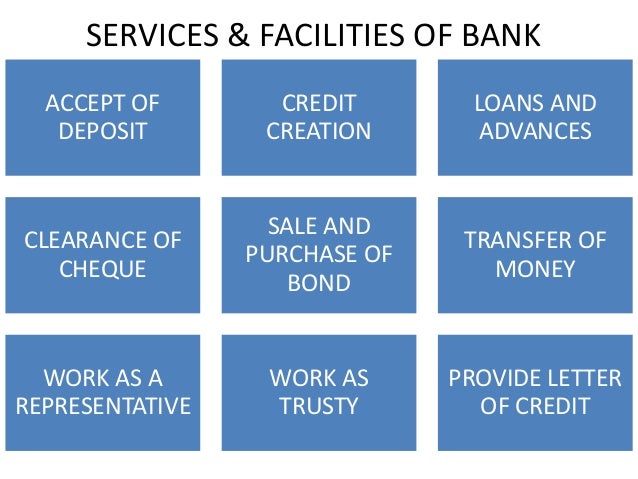

Banking companies come into the organization away from taking in money from depositors, spending her or him a very low interest rate (if any) and lending currency out over borrowers at the a little large costs and you will making money throughout the bequeath between what they’re spending and you can what they are meeting from inside the notice.

If needed, federally chartered finance companies can borrow cash about authorities, on a highly low-rate. Once again, the bank can also be provide these types of finance out during the a higher rate and you can derive earnings from the money.

What is a private Lender?

Personal loan providers are funded because of the investors, otherwise from the finance companies, or one another. Private lenders can be found in the business of delivering funds from personal traders and you will and work out individual team objective funds that have those funds.

The fresh buyers expect a good come back using their assets, and you will interest off currency lent of banking institutions is significantly highest versus financial institutions are being billed on finance. This type of circumstances raise the private lender’s costs, that’s next died towards biggest debtor.

Personal Bank compared to Financial Mortgage Research

Financial institutions are frequently harder to handle than personal loan providers. Finance companies is at the mercy of tall state and federal statutes, plus programs established because of the governmental and you may quasi-political enterprises instance Fannie mae, Freddie Mac, the newest Veterans Government, in addition to Company out of Homes and you can Metropolitan Development. These regulations commonly dictate just what organizations a lender normally provide to and you will exactly what acquire pages should look instance.

Private loan providers, when you’re nevertheless subject to federal and state statutes, are reduced controlled and can be much more versatile on the particular money they make and you will who their customers are.

Accordingly, could it possibly be basically easier to get approved of the an exclusive financial than simply a timeless bank, as individual lenders have the ability to modify for every single loan according to some inside place requirements, such credit ratings, loan in order to well worth proportion and you can debt so you’re able to money levels.

Financial approvals was system otherwise computer inspired with little discernment readily available to the lender. Personal lenders generally simply take a very commonsense approach to skills affairs and you may beating her or him.

At exactly the same time, banking institutions commonly look at financial histories and you will credit as a result of easily traceable and you may reported money offer, it is therefore very hard for notice-operating consumers to be eligible for loans from banks.

Personal loan providers are certainly more creative and you may investigative when you look at check loans Lowndesboro AL the qualifying income that will end up being ready to neglect record problems up on reasons.

- Large Interest levels More pricey

- Shorter

- Smoother Acceptance Procedure

- Shorter Controlled Way more Flexible

- A great deal more Customizable Loan Selection

- Down Interest rates Less costly

- Slow

- Far more Scrutinized Approval Process Including Financial history and you can Credit Audit

- Subject to Significant Authorities Legislation Less Flexible

- Rigorous Financing Options Due to Rules

Looking for a loan provider To own an investment

It’s important to remember that the real difference for the rates ranging from a lender bank and you can an exclusive financial can be not very much whenever making reference to a short-term financing.

Summation, finance companies are a good choice for those who have an easy, simple property to finance. However, an exclusive home lender is far more planning to financing a beneficial mortgage toward a challenging property, into the a smaller time.

For these trying instantaneously invest in possessions, an exclusive bank usually close the loan shorter, that have reduced problems into the debtor. This can let the debtor to expand the organization faster, that makes the extra short term can cost you from an exclusive financial useful.

Selecting the sort of lender that is perfect for a real estate buyer isnt simply a point of the least expensive solution offered. A borrower that won’t qualify for a bank loan is also spend months, if you don’t weeks waiting for a choice from a lender whenever they may have been acknowledged and you will moved submit having an exclusive financial in just days.

After you choose which types of lender suits you, have fun with our house Turning Calculator observe how much cash flipping an excellent family costs!