Even when you may get a sophistication several months (and just how a lot of time) immediately following getting a private youngsters loan utilizes the financial institution. The fresh sophistication months having government students fund always can last for on half a year after the debtor simply leaves college.

One method to make the most of the grace months is to generate mortgage payments within the elegance period or even although you remain in school. You do not have to do it, but if you is also, you ought to. Your ount your financing accrue in the interest per month. As much as possible enable it to be at that, it might indicate faster notice commonly gather and also have put in the prominent harmony once you enter installment.

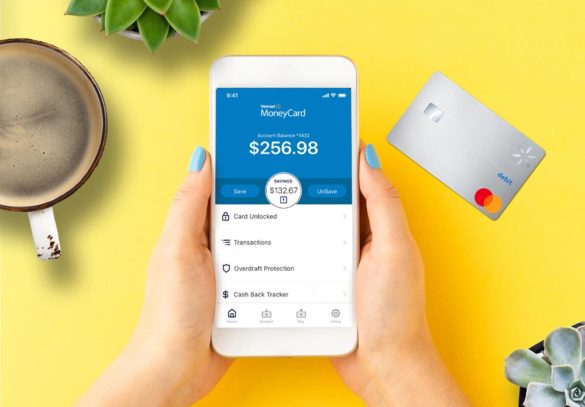

You could shell out your own money immediately by joining automated debit. If you register for automated debit, the pupils financing servicer tend to automatically subtract the conformed count out-of your bank account month-to-month. It will help to ensure that you create your repayments continuously and you may on time just like the later money could poorly apply elitecashadvance.com loans for bad credit online to your credit rating.

More a few of these, enrolling to own automated financing deduction you certainly will focus to you a destination rates avoidance. All you need to create is always to contact your mortgage servicer to see if your loan is approved to own interest avoidance. Ask for the brand new terms and you can register for automated debit.

6. Make an effort to Continuously Pay A lot more Month-to-month.

Whenever you pay a little greater than the desired lowest number per month, you are going to somewhat slow down the total matter repayable. Although this is almost certainly not easy, it will always be beneficial.

You are going to pay off their money reduced for individuals who consistently spend absolutely nothing even more per month. When possible, allow additional commission amount become spent on their higher attention money very first. Which will help in order to free up currency to you regarding long term.

If the, for-instance, you are taking a student-based loan away from $12,500 from the 3.4% interest and you will good 5-12 months pay months, the loan create rates would pricing $144 30 days.

You could potentially try for a tiny, smoother more to enhance $144 to reduce the repay several months. If in case you really can afford to blow $700 30 days rather than $144, you’d be capable romantic your debt in just about three many years!

eight. Get an area Hustle to increase Your revenue.

This point comes after definitely regarding the past part We produced significantly more than. For folks who need to create more on the minimal fee to help you reduce the accumulated desire and payment period, then you definitely need certainly to earn more.

And make so it you can, you need to choose a part-big date employment on the evening otherwise vacations to make money a lot more rapidly. After you get this to money, contain the additional cash with the financing installment. While possible, bust your tail adequate to post costs more often than once when you look at the 30 days particularly, every two weeks.

Dont supply the sluggish people’s excuse, I don’t have time for various other job. When you have time to speak toward social media, enjoy games, hang out having relatives otherwise check out Netflix, you may have for you personally to build several more funds. Therefore break in inside.

Think of, be consistent along with your side hustle but don’t performs too hard. Just be sure to however get a hold of time for you to research thoroughly and other extremely important one thing with respect to your own academics.

8. Understand Truth From the Children Loan Forgiveness.

There are a lot of scanty information about student loan forgiveness available. Of a lot programs do not suffice the complete realities. It let you know that it is ok when deciding to take college students financing once the you can get loan forgiveness later and get without your financial situation. So it, such as We said currently, was a half-basic facts.